The central bank and commercial banks are two important components of a financial system. They have different mandates, functions, and operations but they both play an important role in maintaining stability in the economy. Today, we shall show you the differences between central banks and commercial banks.

They are responsible for controlling the money supply, maintaining stability in the financial system, managing interest rates, and providing foreign exchange services to banks.

The central bank has the mandate to control inflation, maintain interest rates and manage the foreign exchange rates.

The central bank is responsible for controlling inflation, maintaining interest rates, and managing the foreign exchange rates. The central bank has the mandate to maintain the value of the currency in terms of goods and services.

The goal of the money supply is to keep prices stable at a certain level. There are several ways that a central bank can achieve this goal. One is by implementing monetary policy through open market operations, which involves buying and selling bonds from commercial banks; through changes in reserve requirement ratios (RRR) set by legislation; by lending money directly to commercial banks; etc.

You may be wondering: What is the difference between a central bank and a commercial bank? Or perhaps you have been told that there are some similarities between these two financial institutions. Let’s look at each of these points in more detail.

Read this also: differences between the email address and Gmail address (step-by-step).

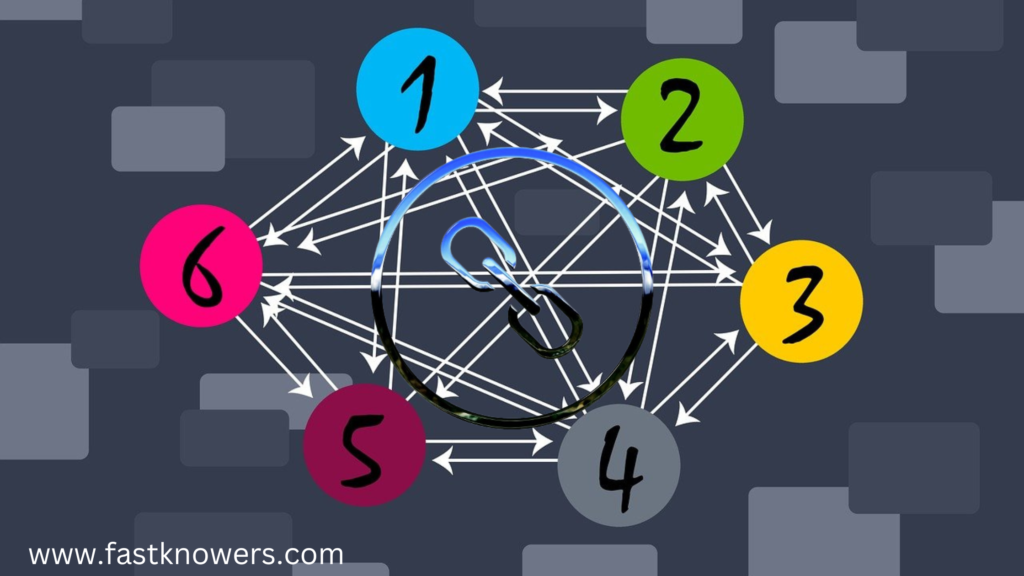

Differences between commercial banks and central banks

- The primary function of commercial banks is to lend money.

- Commercial banks provide loans to businesses and individuals.

- They both offer other financial services such as investment and insurance.

- Commercial banks are regulated by the central bank, which supervises them through periodic examinations.

| Central banks | Commercial banks | |

|---|---|---|

| 1 | The central bank plays a key role as it controls interest rates and reserve requirements on behalf of government agencies like treasury departments and other ministries. | A commercial bank is not responsible for controlling the supply of money in any economy. It does not have any role in regulating or controlling the money supply, and its role is limited to lending out funds that it has access to. |

| 2 | Both the central bank and commercial banks are an integral part of the financial system, but they differ in terms of their functions, operations, etc. | Commercial banks are responsible for maintaining public confidence and stability in the banking system. |

| 3 | The central bank also influences interest rates by varying its own lending rate (which is called the discount rate). By doing this, it affects how much banks pay depositors for holding their money with them and thus how much people will be willing to deposit with them (or withdraw from their accounts). | Commercial banks are responsible for maintaining public confidence and stability in the banking system. They also play an important role in providing credit to customers, businesses, and governments, including funding government deficits or investing in risky securities (like stocks). |

| 4 | They also regulate other aspects of financial markets such as credit cards and mortgages so that they don’t become too risky for consumers who might use them without due diligence. | If you have money at a commercial bank, your assets are under their protection; but if you have assets with your respective central bank account (e.g., USD), then those assets will be protected by both parties involved in the government and its own citizens. |

| 5 | The central bank plays an important role in the financial system by controlling inflation, maintaining interest rates, and managing the foreign exchange rates. | Commercial banks do not have any role in controlling the supply of money in the economy as they cannot create new currency or deposits out of thin air like a central bank would be able to do (although some countries have made it legal for commercial banks). |

| 6 | They have special legal privileges that are not enjoyed by commercial banks. One of these privileges is the power to regulate commercial banks. | There can be more than one commercial bank in a country but the central bank must be only one. For example, the central bank of the United States (USA) the central bank Nigeria, etc. |

| 7 | The central bank is an institution that oversees the banking sector as a whole. It’s responsible for controlling inflation, managing the supply of money in the economy, and maintaining public confidence and stability in its banking system. | Commercial banks, on the other hand, lend money to businesses and individuals. |

| 8 | The central bank is always public (owned by the government). | Commercial banks are always privately owned. |

| 9 | They are not founded for profit-making purposes. | Commercial banks are established for profit-making. |

Conclusion and more reading

The main function of both institutions is to ensure public confidence and stability in their respective sectors.

Now, we hope that it is clear to you that there are differences between a central bank and commercial banks.

If you know that this article has helped you know the differences between commercial banks and central banks, then please share it with your friends and remember to subscribe to our newsletter or like our Facebook page for more important updates.