In this page, we are going to look at what does NDIC mean or what is the meaning of NDIC and some of its roles or functions.

NDIC is an acronym and it stands for Nigeria Deposit Insurance Corporation. Now, we are going to list and explain to you the top 10 roles or functions of NDIC.

Nigeria Deposit Insurance Corporation is a system established on 15th June 1988 by federal government of to protect depositors against the loss of their insured deposits placed with member institutions in the event that a member institution is unable to meet its obligations to depositors.

NDIC engenders public confidence and promotes the stability of the banking system by assuring savers of the safety of their funds.

Read this also: list of all Nigerian banks and their headquarters address

List and explanation of top ten roles or functions of NDIC

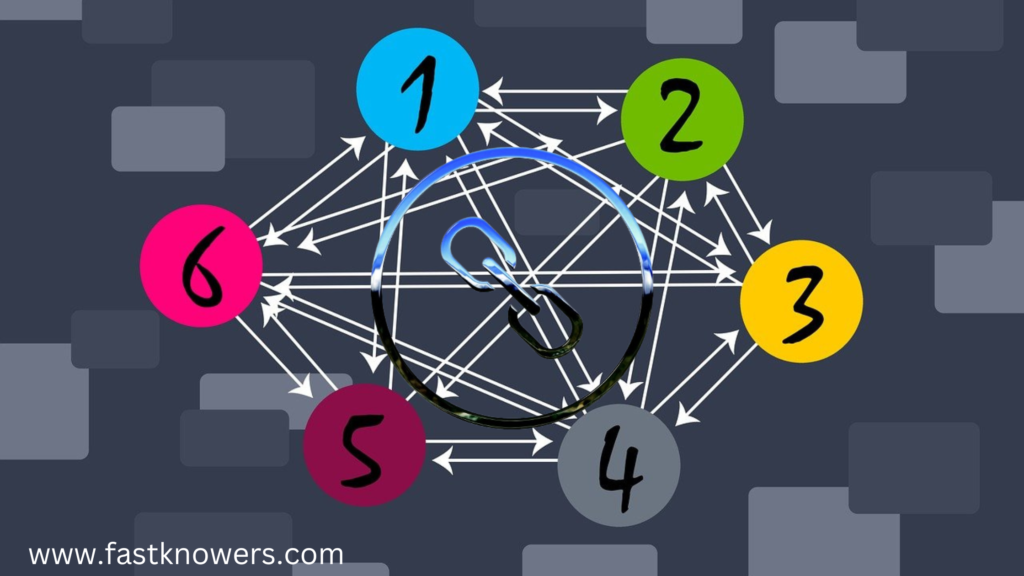

Now that I have just defined with you the meaning of NDIC, the list of top ten roles or functions of NDIC are explained below step by step:

- Insuring all deposit liabilities of every bank

One of the roles or functions of Nigeria Deposit Insurance Corporation is it ensures all deposit liabilities of every bank in Nigeria.

- Giving assistance to other Nigerian bank

Another role of NDIC is giving assistance to other Nigerian bank in the interest of depositors, in case of imminent or actual financial difficulties of banks particularly where suspension of payments is threatened, and avoiding damage to public confidence in the banking system;

- Guaranteeing payments to depositors

It is a role of NDIC to guarantee payment to depositors in case of imminent or actual suspension of payments by insured institutions up to the maximum.

- Assisting monetary authorities

Another role of NDIC is assisting monetary authorities in the formulation and implementation of policies so as to ensure sound banking practice and fair competition among insured institutions in the country.

- Pursuing any other necessary measures

One of the top ten roles or functions of NDIC is it must pursue any necessary measure to achieve the functions of the Corporation provided such measures and actions are not repugnant to the objects of the Corporation.

The Nigeria Deposits Insurance Corporation (NDIC) assists in the formulation of policies and the implementation of the policies formulated.

- Enlighten individual

The NDIC publishes and distributes books on deposit insurance and banking to enlighten the public. Recently, a book on basic knowledge on banking and deposit insurance was distributed to all secondary schools nation-wide with the aim of catching them young.

The NDIC also undertook a study on financial literacy, the report of which was published in book form in order to facilitate readership within the banking public and to assist stakeholders address the challenges of financial literacy.

- Liquidating Bank

Liquidating banks is another role of NDIC and it is explained further below.

This, however, formed one of the functions of the Nigeria Deposits Insurance Corporation. Because there are some banks that failed to respond to the measures of failure resolution with their customers.

Hence, it is the function of the Nigeria Deposits Insurance Corporation to adopt bank liquidation option in such case, where banks failed to respond to the failure resolution measures.

When we talk about the liquidation process, it has to do with efficient and orderly closure of such failed institutions.

The bank liquidation option is always adopted by the Nigeria Deposit Insurance Corporation for banks that fail to respond to failure resolution measures.

Liquidation process involves orderly and efficient closure of the failed institutions with minimum disruption to the banking system, cost-effective realization of assets and settlement of claims to depositors, creditors and where possible, shareholders.

Hey! Read this list of all approved Microfinance banks in Nigeria and their locations

Roles of NDIC in regulation of Nigerian banks

Banking supervision is an essential element of the Nigeria Deposit Insurance Corporation (NDIC) scheme as it seeks to reduce the potential risk of failure and ensures the unsafe and unsound banking practices do not go unchecked.

Hence, the Nigeria Deposit Insurance Corporation, NDIC supervises banks so as to protect depositors; foster monetary stability; promote an effective and efficient payment system; and promote competition and innovation in the banking system.

As an Insurance Corporation organization, the Nigeria Deposits Insurance Corporation has a function of making sure that every deposits liability of every bank in Nigeria is licensed.

This particular function of the Nigeria Deposits Insurance Corporation does not stop at licensed banks, it served also other financial organizations particularly those ones that are insured, provided they operate in Nigeria as it is in accordance with section 16, and section 20 of the Act.

Conclusion

If you know that this article has helped you know the meaning of NDIC (what it stands for) and roles or functions of NDIC to all other banks in Nigeria, please share it with your friends and remember to subscribe to our newsletter for more important updates.

Read these also: